Welcome back to the third part of our six part series. We are about to cover “Find a Budget that Works for You”. If you would like to to review our recommended list or previous posts on our process, please review and click any of the links below.

Calculate your savings needed to reach your goal

Calculate your savings needed to reach your goal

Find a budget that works for you

Find a budget that works for you

Track everything for the first month or two

Track everything for the first month or two

Adjust

Adjust

Review your progress

Review your progress

So here we are. The meat and potatoes of any budget process. As I have said before, I find when talking to those have struggled with budgeting in the past, it’s been because budgeting can be quite daunting without a little bit of guidance on how to set one up. Below I will break this part of the budget process into two steps.

1. Finding the best place to track our budget

First, where do we want to keep track of our budget? There are may ways you can do so, whether old fashioned pen and paper, using an excel spreadsheet, or using an online resource.

Our first recommendation is to go and check out a website like Mint. As a free service, we have used Mint for many years and it has been a great way to create a simple budget online and link your accounts (banking, property, investments) to get a complete picture of your finances. It has many other benefits but for the purposes of this post let’s take a quick look at the budgeting tool. (Just a side note: We were not paid to endorse Mint.)

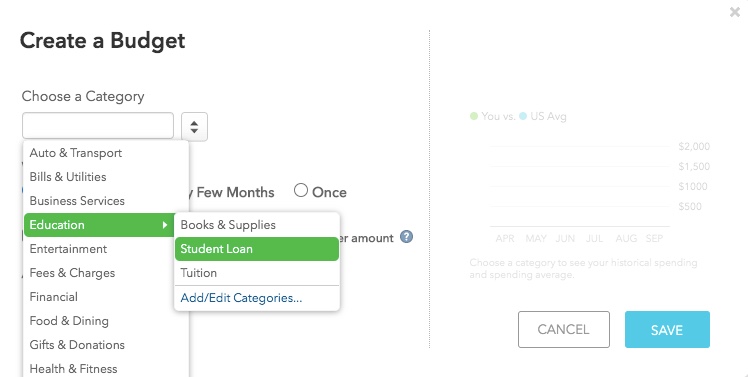

Mint has a simple way to create a budget, with enough customization to create our own tags for categories we can track monthly. As the month goes by Mint attempts to classify our purchases and will email us if we overspend in a category.

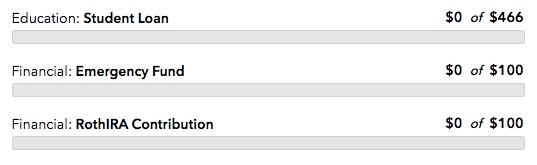

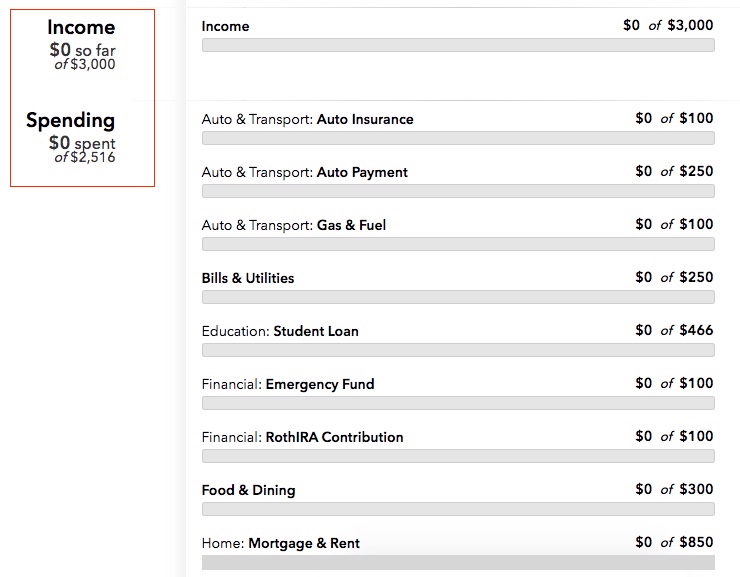

Here are some example photos of Mint.com in action.

There is a pretty big list available to you (not fully shown), but you can also add/edit categories to create your own specialized parts of your budget.

If we are on track to meet our budget spending allotment in a month, the line item will turn yellow, and eventually green once the month is done.

If we overspend our budget amount in a given month, it will turn red.

The best part about Mint.com is that it’s smart enough to categorize your transactions for you. It won’t be perfect, so once or twice each month I recommend to quickly check in on your budget and update any category tags that are incorrect. For example, we may go to the gas station during the month for the sole purpose of buying milk. Mint will put that transaction in our gas category, but really it should go in our “Food and Dining” category. Updating transaction tags over the course of a month takes about 5 minutes a month.

I strongly urge anyone who hasn’t set up a budget before to give this a try. It really does most of the heavy lifting for you.

2. Choose the categories you want to track

As I stated in our opening paragraph to this series, there are a bunch of methods to creating a budget. I will share what I think is the best. This is my interpretation of the “pay yourself first” budget. For this type of budget, we want to contribute to our goals and things that improve our finances first. I will continue using our hypothetical scenario of wanting to pay off our school loans faster, which is going to cost us an extra $300 per month.

First, create a line item for your expected income for the month. Even if your income is unpredictable, you can change each month and still see if your budget will work. Let’s set our monthly income budget at $3,000

Second, input categories into the budget that “pay you” or further along your financial future. This includes any goals that we have set.

Third, fill out the budget with categories that you absolutely pay each month. This is saved for Utilities, Food, Rent/Mortgage, Gas, and other Bills that come out of your account(s) each month. You can create a line item for each individually, or if you would rather, group certain fixed costs together. It is up to you. For example, Utilities may include Electric, Trash, Mobile Phone, Internet, etc. Let’s see how our budget is looking so far.

This is the place you will want to spend a little bit of time reviewing your old transactions and determining a realistic average cost for things like Utilities, Food, Gas, etc.

Finally, we want to create an everything else budget. It looks like we have almost $500 left available to spend based on the area outlined in the graphic above – so we create a line item for that too. I call this “Miscellaneous”. This is the section for money you know you will spend, but can’t anticipate. For example, your plunger breaks and need a new one, you need a new outfit for work, etc.

If you think your budget is reasonable, great! If not, do a quick review and make one of two decisions. Do you have too much in your miscellaneous section? If so, consider making another goal to break it out. Too little? Then re-evaluate if your goal is attainable or consider reviewing your budget for areas you can trim costs.

Once our budget process is created we can pat ourselves on the back. The hardest part is over. The next step is to be conscious of our budget over our first few months and notice the trends which I will post more about next week.