Recently, Mrs. Doughmaker and I have been considering a lot of potential changes to our finances. For example, we have considered selling one of our vehicles to become a one car family. With both of us working from home indefinitely, selling one car would put some extra cash in the bank while reducing the cost of our car insurance.

Decisions like this do not come easy for me as I love to (over)analyze these situations. Is now the right time to sell a car? Will I get the best price for it as there may be other families considering the same thing? Could our family of 5 truly live with one car? Would we run into situations where we would feel stuck if both Mrs. Doughmaker and I needed to get somewhere?

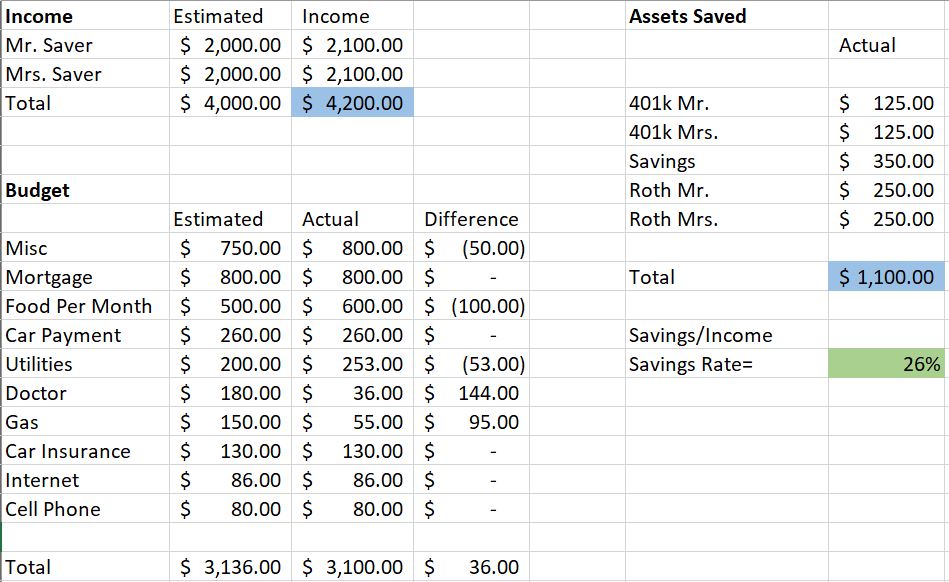

Sometimes these decisions cause me a bit of anxiety and to help quell that feeling I turn to my budget spreadsheet to make a mathematically sound decision. My spreadsheet reminds me of our long term goals. On our budget we make sure our savings rate is updated monthly to reinforce we are making good decisions for our financial future.

Our budget spreadsheet is split out each month to show our expenses vs our income so we can segment how we did each month. This provides consistent reinforcement and allows fine tuning of our budget. Additionally, we have an annual sheet that calculates how we are doing so far annually towards the budgeting goals we set back in January.

One of our goals this year was to keep our savings rate above 35%. We knew that if we kept our savings rate that high, and we continued over the next few years, we could have some of our other goals realized, whether short/mid-term, like building a house, or long-term such as retiring early. But what exactly is savings rate? To me, it is the most important calculation you can use to determine your financial success.

What is Savings Rate?

Simply put, your savings rate is savings divided by income. This percentage represents the income you save (as the rest should be used for expenses). There is some nuance here that I will cover quickly, but thats pretty much all there is to the calculation.

One question (and an important one) is whether to use gross income vs net. I suggest using net, or take home, income for your calculation if you are new to calculating savings rate. This eliminates the need to bring taxes into the calculation. It will get the number close enough to be tangible, however a more complicated calculation is needed to find your precise savings rate. This is mainly due to pre-tax savings coming our of your paycheck not being weighted appropriately.

One other consideration is whether to include any match from your employer into your savings rate. I would say you DO want to include any employer savings into a 401k or Simple IRA plan. If you are contributing $100 to your 401k and your employer is contributing $25, use $125 dollars overall in your savings as the $25 is going towards your savings and wouldn’t be there if you otherwise were not contributing.

How Savings Rate is a Powerful Tool: An Example

The numbers are simplified but this example will give you a pretty good indication as to how you can set up a template for your monthly budget and calculate your savings rate. This example shows a sample budget for a household making roughly $65,000 in gross income.

Once you have your savings rate calculated, do yourself a favor and use this tool at https://playingwithfire.co/retirementcalculator/. This tool shows you what year you could potentially retire based on your current savings rate and a few other factors. Using the example above, here is the result for this household’s financial independence.

These are great tools because if your long term goal is to retire early (say you want to retire early at age 55) you can easily see here whether your current plan and savings rate have you on track to meet those expectations. Also, it’s pretty easy utilize the tool to either add additional income, or to remove expenses to find out what it would take to get you on track towards your goal.

Where Do You Measure Up Nationally?

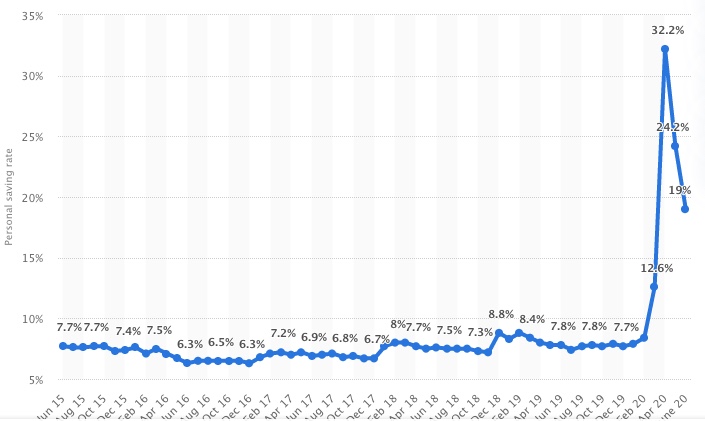

I hope that this post encourages everyone to take a few minutes and calculate his or her own savings rate. As I do frequently, I look for statistics to determine where I stand in comparison to my peers. I read a lot of news regarding personal savings and how it is lacking in the United States. There are articles constantly mentioning those who have not saved for retirement and are not on track. These articles intensified as we started navigating our way through the COVID-19 pandemic. I’d like to share one with you regarding savings rate in the United States historically.

On average, Americans save less than 8% of their income each year. This graph was interesting as it shows how once Americans were shuttered from going places, their savings rates increased drastically.

Final Thoughts

Thinking back to our original question of whether to sell our car, I determined it might be a good opportunity to do so. As I will probably be working from home for at least the next 6 months, I could get rid of my car payment and sell my vehicle for $3,000 over loan balance. Currently The Doughmaker’s household savings rate is at a respectable 37%. If we were to get rid of our vehicle, it would save us in car insurance and car payments totaling roughly $300 a month (plus depreciation and maintenance).

If we invest that $300, it also would increase our savings rate by 3%. I am not 100% sold that its the right choice as we like the freedom of being a 2 car family, but the numbers are painting a picture that shows it might be best to sell the vehicle.

Care to share your savings rate? Let us know in the comments below!